Home

Leadership making more deals happen

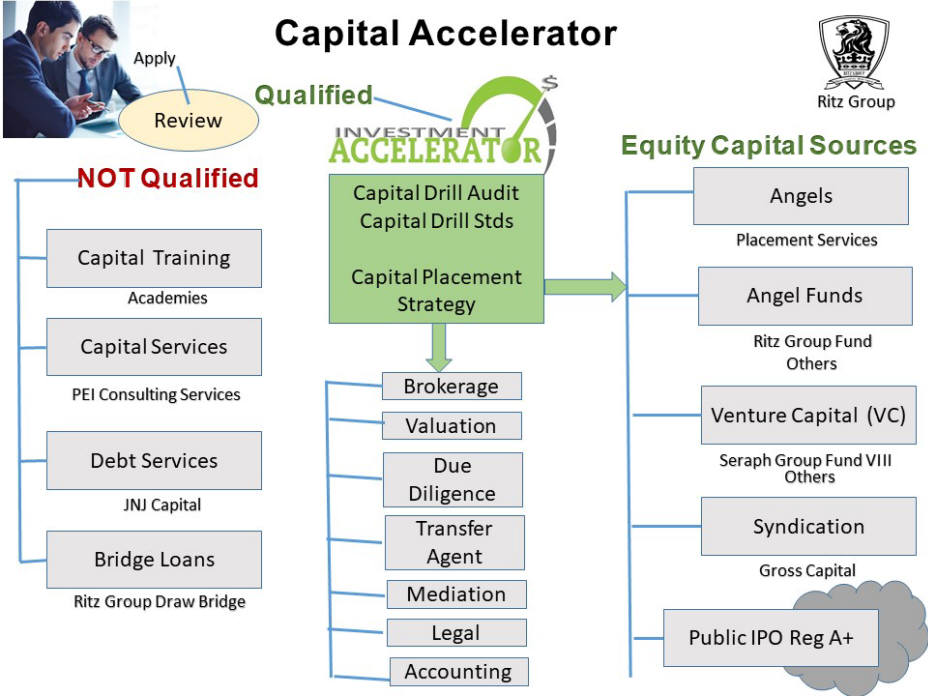

The goal of the investment Accelerator is to provide the expertise to guide companies raising seed and series A, B rounds through the private Equity process. The end result is to define a strategy for best placement an funds and to insure all of the requirements are in place to qualify.

Step ONE is a

A formal 20 Step Audit of your Investor readiness with your Founders team to validate your companies value proposition followed by a review of your physical collateral (website, products, & printed material), plus Investor collateral (Exec Summary, Financial pro-formas, Pitch Deck, Terms Sheet and Cap Table) to identify GAPs and consistencies with your value proposition. Verbal assessments will be supported with a written recommendation on positives, red flags and course corrections.

The Ritz Group Capital Drill methodology will be used to model existing stakeholders and define down round placement strategies to insure the five year funding strategy is in synch.

Finally, a capital placement strategy will be defined to include identifying best capital resources along with the recommended strategy for fulfillment.

Investment Accelerator Program

About

Board

Events

Sponsor

Sign In

Contact Us

Partners

The Ritz Group Investment Accelerator recognizes that raising seed round funding is a complex drill that represents a major challenge for companies raising their FIRST equity round. Also, the equity raise process is one that, in today's environment, exceeds the reach and resources traditionally offered by legal, brokerage, organizations, co-working space/accelerators, universities and often the skills of many entrepreneurial teams.

Investment BLOGS: Providing Angel Club Members with Investment topics to continue the investment discussion. Topics are often derrived from discussion topics generated at the Luncheon.

Larry White, President & CEO Ritz Group

Who's on First? Defining the Capital Arena

What's on Second? The Valuation Variant

You Want to do What? Lower Members, Revenue and EBITDA forecasts to make the stakeholders happy

A BRIDGE to Far? Or, maybe the smart strategy

Want a Guarantee - Go to Midas? New debt loan idea for smaller players