Home

Georgia Stock Exchange

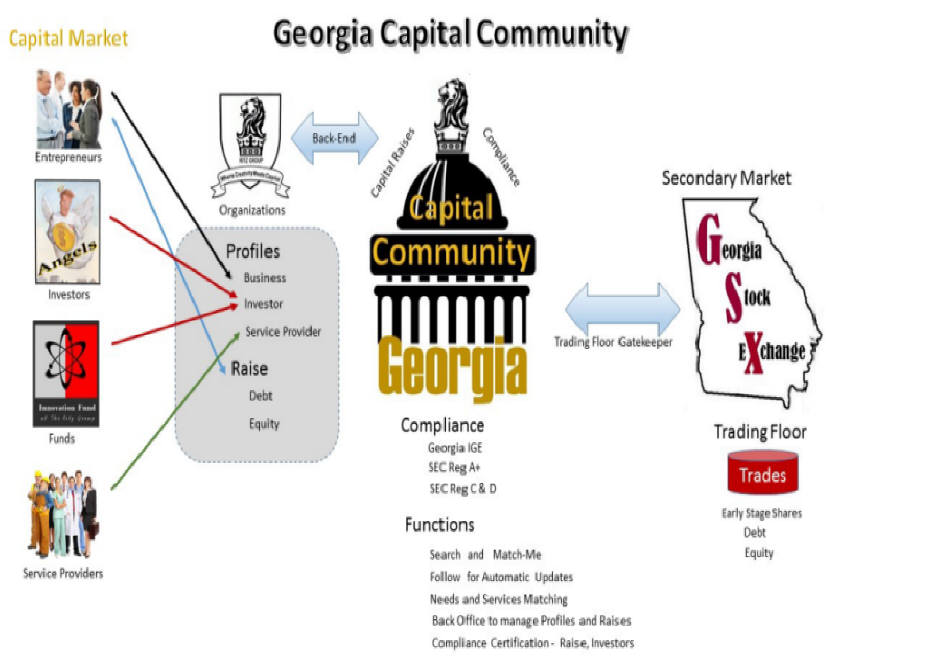

The Ritz Group mission is to promote Georgia's early stage entrepreneurial business growth. The focus is on the Red Zone of Funding defined as the final 20 yards required to secure private equity rounds defined as Angel Rounds, Series A and B.

The private equity capital funding GAP in Georgia is the Angel Round - especially since the 2002 when the Internet bubble broke. The market is back, but the Angels are not. Georgia's shortfall is limited by the number of successful company exits that come back to invest in Georgia's early stage company Angel Round funding.

The Challenge is to re-invent the Angel Market in Georgia. Make it an investment instrument that attracts wealth investments (Angels). The goal is to create a market that has the opportunity to realize short term earnings and also the opportunity to leverage loss.

The problem with today's Angel investing, besides the high risk, is there are no returns or exits until the company is sold, M&A's or IPO's. A worse scenario is the large number of companies that are parked for any number of reasons - funding, revenue or competitive issues. Often the successful investor exit is a 5 to 10 year proposition. No serious investor wants to wait that long to see a return - even for home run potential

The goal of the GSX is to provide a fully compliant EXCHANGE where early stage company stock can be registered and sold to accredited and non-accredited investors in a venue that insures the trade is fully compliant under the securities Laws of Georgia (IGE) and/or the Federal Crowd-funding laws specified by the SEC. (Reg A, Reg C and Reg D)

The GSX advantage is the creation of a NEW market for Angels that means they can invest and follow with options to exit and realize a gain or control a loss. GSX also provides a venue Angels can closely follow investments to increase or decrease ownership before the mass exit (M&A, IPO)

The Ritz Group is leading the project and has the technology platforms to manage the compliance front-end, plus trading-floor exchange. To learn more contact us.

Contact Us