Home

Capital Drill

Recently a group of our Angel Club Members met to discuss how we re-train and create more Angels in Georgia. In the room were over 250 years of Georgia Private Equity experience. They came up with two conclusions.

First, today's private equity investing (PEI) is too complex, confusing and suffers from NO... to BAD hype or Buzzzzz. PEI is a "black art" known only by fund managers and VC who use it to their advantage in striking deals

Second, PEI complexity only impacts the engaged Angel Investor in early seed rounds and not passive corporate executives who write checks without getting engaged at the micro management level.

The CAPITAL DRILL de-mystifies and simplifies the Private Equity Investment Process. It is a very simple process and framework enabling both entrepreneur and Angel Investor to set-up and manage a shareholder company on an ongoing basis.

Entrepreneurs learn the Capital Drill in Secrets Mini-Camp and see it reinforced in the FastTRAC boot camp. Angels are introduced to the simplicity of the Capital Drill in Angel 101 Boot Camp and again in Angel Boot Camp . The logic and simplification of the Capital Drill insures Entrepreneurs can run a private shareholder company and gives Active and engaged Angles confidence in managing their PEI Portfolio

.

The CAPITAL DRILL is the heart of the Ritz Group Capital Drill Academy's for both Entrepreneurs and Angel investors raising their first seed and series A rounds.

The Capital Drill is the centerpiece of several Ritz Group programs. They are the Capital Audit for investor due diligence and "going private," plus our three Academy Classes (Secrets Mini-Camp, FastTRAK Boot Camp, and Angel Academy),

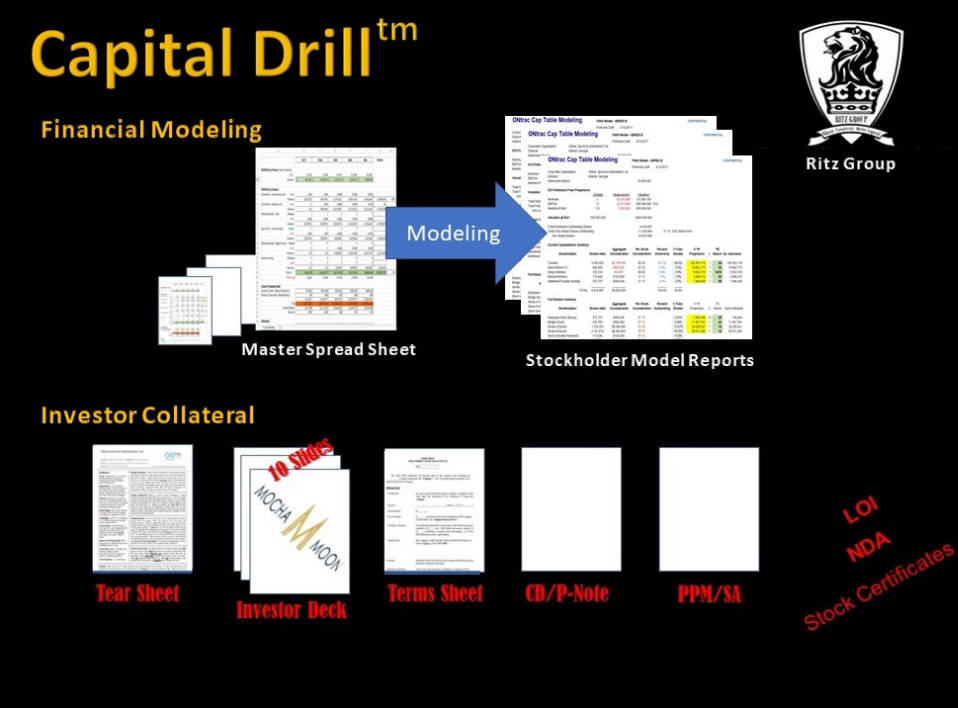

At the heart of The Capital Drill are two related Spread Sheets. They are created from projections created in Biz Plan and spreadsheets used in creating operational plans. When completed, they create the "numbers" for the five (5) PEI investor collateral. It is BLUEPRINT to get PEI to "cookie-cutter." More importantly, it also isolates key management throttles that impact investor returns - which is the essence of private equity investing

Vital in the NEW Capital Drill is modeling initial projections to find the ROI for a 5 year exit to include full dilution and valuation multiples based on Members, Revenue and EBITDA. The modeling goal is to find and focus on the key numbers to yield investor ROI. Yes, modeling output is a one page business plan the board uses to track the busines performance. Capital Drill Modeling is online to facilitate modeling through exit.